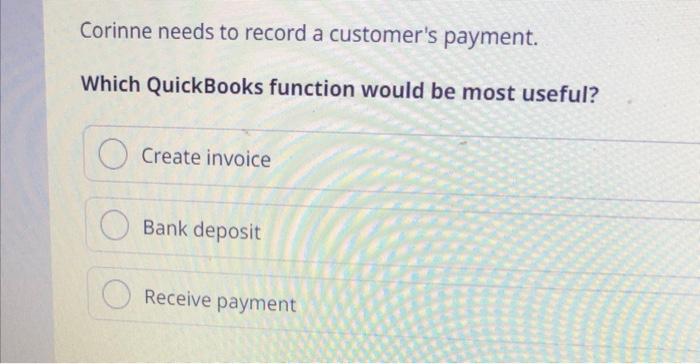

Corrine needs to record a customers payment – Corrine needs to record a customer’s payment, and this comprehensive guide will provide her with all the information she needs to do so accurately and efficiently. This guide will cover the step-by-step process of recording a customer payment, as well as methods for verifying the authenticity of customer payments and sending payment confirmation.

It will also discuss how to integrate payment recording with accounting software, identify potential security risks associated with recording customer payments, and handle customer inquiries related to payment recording.

In addition, this guide will provide tips for resolving payment disputes or errors, explain industry regulations and compliance requirements related to payment recording, and explore ways to automate payment recording processes. With this guide, Corrine will have all the tools she needs to record customer payments quickly, easily, and securely.

Customer Payment Recording Procedures

Accurate and timely recording of customer payments is crucial for maintaining financial integrity. The following step-by-step process ensures efficient and accurate payment recording:

- Receive payment from the customer through designated channels (e.g., cash, check, credit card).

- Create a payment record that includes the following information: payment type, amount, date received, and reference number.

- Verify payment details against customer information and payment method.

- Record the payment in the accounting system, ensuring that the transaction is accurately reflected.

- Issue a payment confirmation to the customer.

| Payment Type | Amount | Date | Reference Number |

|---|---|---|---|

| Cash | $100.00 | 2023-03-08 | INV-1234 |

| Check | $250.00 | 2023-03-10 | CHK-5678 |

| Credit Card | $300.00 | 2023-03-12 | CC-9012 |

Payment Verification and Confirmation: Corrine Needs To Record A Customers Payment

Verifying customer payments is essential to prevent fraud and ensure accurate accounting. Methods for payment verification include:

- Bank verification:Contact the issuing bank to confirm the validity of checks or credit card payments.

- Address verification:Verify the customer’s billing and shipping addresses against known databases.

- Email and phone verification:Send confirmation emails or make phone calls to the customer to verify their payment information.

Once payment is verified, a payment confirmation should be sent to the customer. This confirmation typically includes the following information:

- Invoice or order number

- Payment amount

- Payment date

- Payment method

Integration with Accounting Systems

Integrating payment recording with accounting software streamlines the process and ensures accuracy. This integration allows for:

- Automatic recording of payments in the accounting system

- Generation of reports on payment activity

- Tracking of payments by customer, invoice, or other criteria

Examples of payment integration include:

- Connecting a payment gateway to the accounting software

- Using an accounting software with built-in payment processing capabilities

- Importing payment data from external sources into the accounting system

Security Considerations

Recording customer payments involves handling sensitive financial information. It is crucial to implement security measures to protect this data from unauthorized access, fraud, and data breaches. Best practices for payment security include:

- Data encryption:Encrypt payment data both in transit and at rest.

- Secure payment processing:Use a payment gateway that meets industry security standards.

- Employee training:Educate employees on payment security best practices.

- Regular security audits:Conduct regular security audits to identify and mitigate vulnerabilities.

Customer Service and Support

Prompt and effective customer service is essential for handling inquiries related to payment recording. Best practices include:

- Establish clear communication channels:Provide multiple channels for customers to contact customer service (e.g., phone, email, live chat).

- Respond promptly:Respond to customer inquiries within a reasonable timeframe.

- Resolve payment disputes:Investigate and resolve payment disputes promptly and fairly.

- Provide payment updates:Keep customers informed about the status of their payments.

Compliance and Regulations

Payment recording is subject to various industry regulations and compliance requirements. Failure to comply with these regulations can result in fines, penalties, or legal action. Examples of relevant regulations include:

- PCI DSS (Payment Card Industry Data Security Standard):Protects sensitive credit card data.

- SOX (Sarbanes-Oxley Act):Requires accurate and transparent financial reporting.

- GDPR (General Data Protection Regulation):Protects personal data of EU citizens.

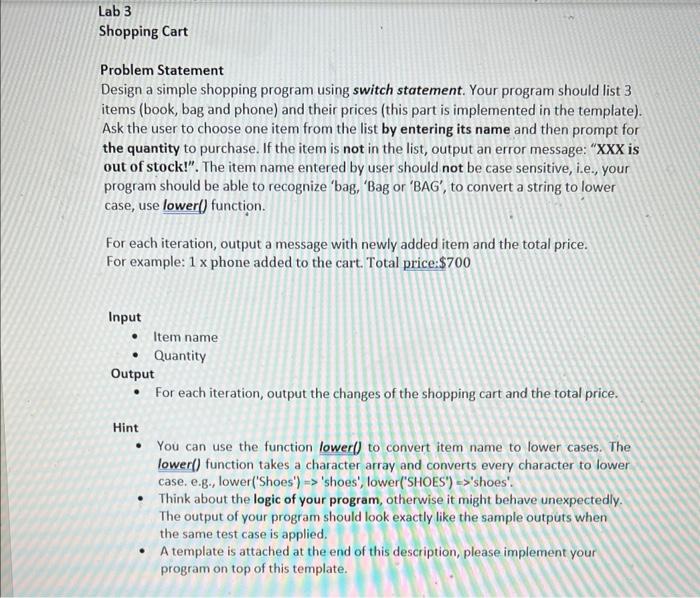

Automation and Optimization

Automating payment recording processes can save time and improve efficiency. Tools and software that can assist with payment automation include:

- Payment gateways:Process payments securely and integrate with accounting software.

- Automated clearing house (ACH):Facilitates electronic payments between banks.

- Recurring payment software:Automates recurring payments from customers.

Questions and Answers

What is the first step in recording a customer payment?

The first step in recording a customer payment is to identify the payment method.

What information should be included on a customer payment record?

A customer payment record should include the date of the payment, the amount of the payment, the payment method, and the reference number.

How can I verify the authenticity of a customer payment?

There are several ways to verify the authenticity of a customer payment, including checking the payment against the customer’s invoice, calling the customer to confirm the payment, or using a payment verification service.

How can I integrate payment recording with my accounting software?

There are several ways to integrate payment recording with accounting software, including using a payment gateway or using an accounting software that has built-in payment processing capabilities.

What are some tips for resolving payment disputes or errors?

Some tips for resolving payment disputes or errors include contacting the customer to discuss the issue, reviewing the customer’s payment record, and checking the customer’s account for any unauthorized activity.